|

|

Taxes and Expenses Projections |

|

Owen Sound Administration Continues to Grow |

|

|

| The Mayor Said: | |

|

|

|

Not Really – In spite of the Mayor 's Assertion – check the Facts for yourself! |

|

"Owen Sound 's administration has not continued to grow. In the 2023 budget, there was a reduction of 3.5 FTES. The 2024 budget recommends adding back only the part-time hours that were previously reduced and two summer student positions" Ian Boddy OwenSoundCurrent.com |

These new positions will cost of $104,000 annually. This annual increase represents a 0.3% tax increase which is about 10% of the likely 3.4% tax increase. As we saw in the past these new part-time positions rarely disappear and continue to cost taxpayers for years, many morph into full-time positions over time - that's staffing growth!

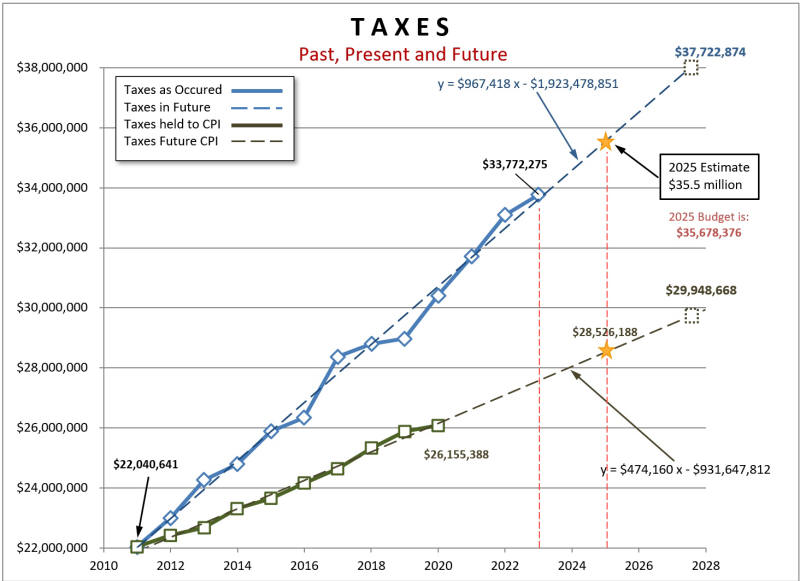

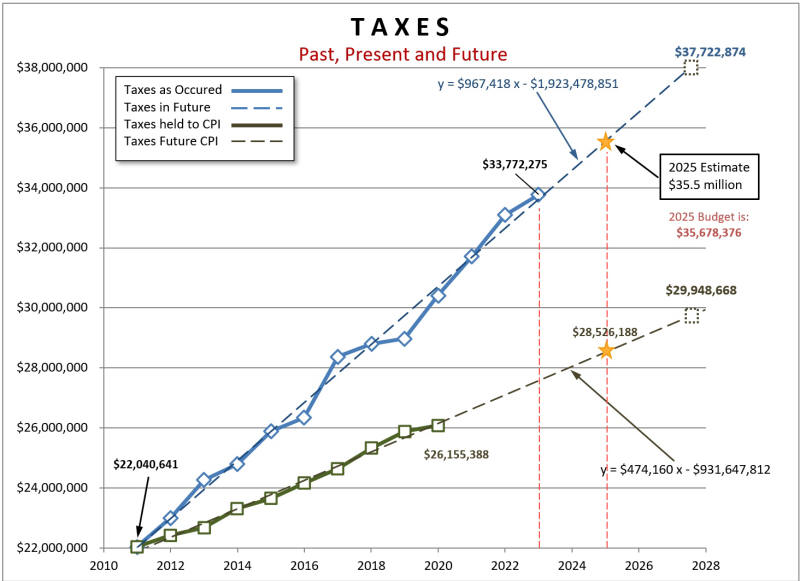

Below is a graphical representation of the trend of Owen Sound 's expense growth since 2011. This graph shows exactly where we are going if Council does not immediately start to aggressively attack this problem. Anyone who tries to put a positive spin on this reality is doing taxpayers an injustice. You will see below that in spite of the Mayor 's comments that we have not “not continued to grow”, the growth in taxes in the 2024 budget is in the order of $1 million and is following the trend shown in the graph below. As well, this growth continued at that rate in the 2025 budget as show by the yellow star. Taxes have been steadily increasing at a rate of nearly $1 million per year as shown by the equation for the straight line projection.

|

|

Taxes and Expenses Projections |

|

| Owen Sound Expenses Projections to 2030 |

|

|

| Owen Sound Taxes Projections to 2030 |

Yes, both expenses and taxes are growing at rates that exceed even today 's inflation rate. It is interesting to note that the 2025 Budget shows revenue from taxation as $35,347,652. This is slightly greater than my estimate of $35,104,660. This suggests that the rate-of-growth of taxes is actually increasing. Note: this is driven by the annual growth in expenses that exceeds $1 million per year which is much greater than the growth in cost of living. Why is that?

In 2024 Council is ignored the facts and approve a budget with an increase of 2.58%. This is much higher than the previous year 's tax increase and slightly lower than the 2.65% increase in the 2025 budget. In 2020 the city's revenue from taxes was budgeted to be $30,810,218. Five years later in 2025 the city's revenue from taxes was budgeted to be $36,247,585 which is an increase of $4,588,327 or 14.5%.

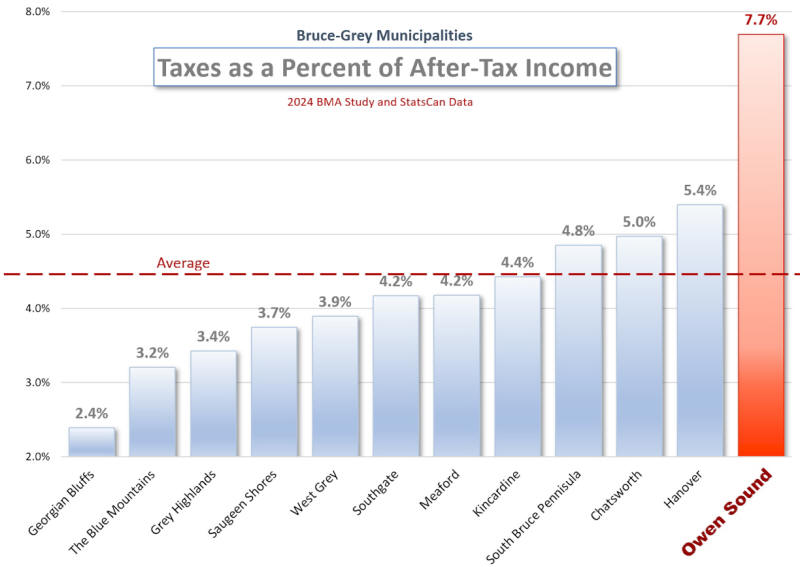

It's important to realize that you cannot fairly compare tax increases among municipalities as a percentage increase in taxes. For example Georgian Bluffs revenue from taxation in its 2025 budget was only $13.7 million as compared to Owen Sound's $36.2 million. Georgian Bluffs has 5,269 total private dwellings according to the 2021 census. Owen Sound, on the other hand, has 10,406 private dwellings.

A 3% increase in the 2025 budgeted revenue from taxation represents a $1,087,427 increase in the tax burden in Owen Sound and a $411,000 increase in Georgian Bluffs. If we divide each by the number of dwellings we get the average increase in the tax burden per dwelling. This is ($1,087,427/10,406) or $104.50 per dwelling in Owen Sound and for Georgian Bluffs ($411,000/5,268) or $78.02.

The bottom line is that when you hear the Mayor brag that Owen Sound's percentage tax increase is less than Georgian Bluffs you can tell him that it is a meaningless comparison. It's the increase in the average tax burden per dwelling that matters. In this example if both municipalities had a 3% increase it would cost your neighbour in Georgian Bluffs $78 and it will cost you $104.

|

|

Taxes on a Bungalow as a percentage of After-Tax Household Income |

Here is a much better way to compare taxes that considers residents ability to absorb a tax increase. The Owen Sound taxpayer spends 7.7% of their after-tax income on taxes; while the average taxpayer in our area spends on 4.4% of their income. This speaks volumes about the financial well-being of Owen Sound families - all families, since landlords pass on taxes in the form of rent increases. In other words Owen Sound taxpayers are unfairly burdened by taxes as compared to taxpayers in our adjacent municipalities.

| What Do You Think? |